A website business can provide greater returns and less risk than real estate investing. A rental property may provide a 6-10% return on your investment, but typically involves carrying a loan for 15-30 years. A website business will usually provide a 28-40% return on your investment and will pay for itself within 30-40 months.

Why I chose to pursue a website business

At some point in the near future, I will want to leave my corporate job. It’s not that I don’t enjoy it, but as I get older, my interests are changing and I’ll need to have more control over my daily and weekly schedule.

My new interests are more focused on exploring some business ventures that I haven’t had time for previously. I’ve been building some websites in recent years to experiment with turning words into money and find it quite rewarding and challenging. The next step is to accelerate that process by acquiring an existing website that’s already earning money.

How websites earn money

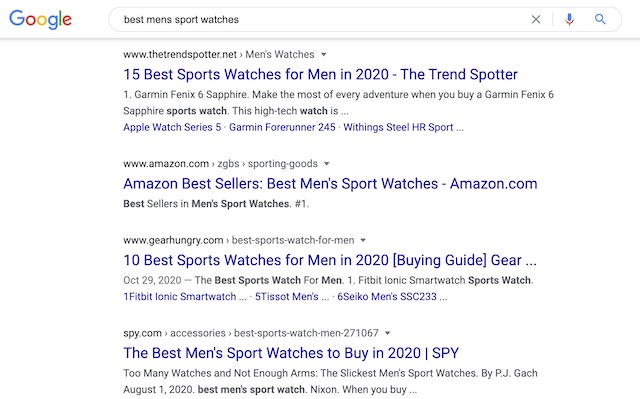

If this concept is new to you, let me briefly explain. When you go to Google and search for information about topic, product or service, you get a long list of results. When you click on one of those search results that Google provided, you now are accessing a website owned by someone who is probably providing valuable information and resources.

While you’re on that website, some advertisements may appear in the page and those ads just earned that site owner a couple of pennies. Or there may be a product link that takes you to Amazon. Clicking on that link means that the website owner will earn a commission on your purchase, if you buy within a certain period of time.

Comparison to other retirement income options

My plan had always been to use real estate as retirement income. I’ve been a landlord for more than 25 years, plus I like real estate and understand how deals work. But a combination of extraordinarily high markets prices and unstable rent income due to the 2020 pandemic, caused me to reconsider that plan.

Time requirements to manage a business

With real estate, a good property manager can take much of the day-to-day burden off your shoulders. Rental properties take very little time if you have other people do all the management, maintenance and repairs. If you choose to do it all yourself, it can quickly become a time-consuming job with minor emergencies that can interrupt your plans.

I have managed property for others and myself. Most houses and small multi-family units require very little time. However, as the number of properties and units increase, it becomes more demanding and requires you to be responsive to tenants needs.

With website businesses, there is some technical knowledge needed, but not nearly as much as you might think. The time demands comes from occasional updates to the website software (which is usually just a matter of clicking a button) and creating new content.

There are other considerations that differ from real estate like making sure your entire website is securely backed up each day and that you have a plan to restore it should something happen to your web hosting provider’s servers.

Most content-based websites require a few hours each week to write new articles, research future topics and check on performance and earning metrics.

Cash required upfront to purchase

Investment real estate (rental house, duplex, apartments, etc.) usually require a 20-25% down payment. Most people do not pay cash for investment properties to make their money go further. Why spend $200,000 to buy one property when you can use that same money to buy four properties using $50,000 as a down payment for each?

Real estate loans are secured by the property, so getting funded is fairly easy and you shift most of the risk to the lender. Interest rates tend to be much lower than other loans too. Even for investment property, mortgage rates are only a few points higher than an owner-occupied property.

Website business finance varies, depending on the price range. If you’re in the sub-$100,000 range and you want to use a loan, your best bet is to just get a personal loan, line of credit, home equity line of credit (HELOC) or personal savings. Business loans in this price range are harder to find since the risk is higher, unless you pledge some other collateral to secure it. If you have great credit, getting an unsecured loan or two shouldn’t be very difficult.

In the $350,000 – $5,000,000 price range, many websites qualify for Small Business Administration (SBA) loans in the U.S. These have their own unique requirements and finding a loan broker who specializes in them can greatly help simplify the process. I was surprised how eager a business loan broker with expertise in SBA lending for websites was to have me apply for a $500,000 loan for a “starter” website business.

This may not be brand new to me, but before I signed my name to a half million dollar loan, I thought I should start off in the $50,000 range and build my skills at evaluating, acquiring and operating a website business. I politely shared my feelings and was told that it’s much less risky to start in the $350,000-$500,000 range. That may be true, but it’s also true that this particular lender doesn’t make loans under that amount, which may influence their advice.

Control over the business

Watching money multiply before your eyes is a beautiful thing. That’s what I love about the stock market. After careful analysis, you execute the trade and watch it move in your direction, reaping the profits that seem effortless. Where else can you take $1,000 and turn it in to $2,000 or more in a matter of days or weeks?

Except when it doesn’t. Stocks can go up, down or stay flat. You have no control over that. In order to prevent rapid and devastating losses, you must have a strategy. It’s not terribly difficult to do, but it does take time to learn how the trading process works, how to minimize losses and how to discipline yourself to take profits and avoid letting emotions control your decisions.

This is a thrilling and sometimes nerve-racking game, and I still enjoy it. Still, I find that I prefer the website business model since it tends to change more slowly and gives you opportunities to use it to help others.

Liquidity

For rapidly converting your investment to cash, nothing beats the stock market. You place an order and usually within a few milliseconds, it’s done. Within two or three days, you can have the cash in your hands.

Real estate investments and website businesses do not share that same liquidity, but are similar to each other. Whether it’s a rental property or a website, you have to determine its value, find a buyer, go through a closing process to transfer ownership properly and assure that everything is order. Only then can you get paid.

In a hot market, a house or a website may get a full priced offer within hours or days, but the closing process will still takes 3-8 weeks. If the market isn’t especially hot or your pricing is too high, it my take weeks or months to even get an offer.

Buying a website business should be considered a long term investment. Although the concept of “flipping” does apply. It is commonly used to buy something that is under-performing, improve some elements that increase traffic or revenue and then sell based on the new performance numbers.

Even after making those improvements, most buyers want to see 6-12 months of stable income, so a 30 day turnaround is not very realistic.

Where to buy websites

Like real estate, the quickest and easiest way to find websites for sale it through a broker. There are many website brokers, each offering a similar, but unique service. Some only deal with websites selling for $350,000 and up. Others only offer websites in the under $50,000 range. Still more cover a wider section of price range and offering special services such as handling the technical work of transferring everything to the buyer, providing detailed and verified earnings reports and escrow to make sure no money is transferred until the deal is done and everyone is happy.

Brokers that I’ve been working with

These are the brokerages that I’ve had some experience with:

EmpireFlippers

EmpireFlippers is my top choice for a few reasons. First, access to listings do not require any membership fees. During the sign up process, you have the option of providing proof of funds available which is reviewed by their staff. If you show them a bank balance of $50,000, they will give you access to all listings up to $100,000. I believe this is to allow for the option of creative financing, much like seller financing in real estate.

This option works great for me since I have a predetermined price range in mind and am not currently interested in listings of $500,000+. It also shows credibility as a buyer. There is no doubt that I have the funds available to make the purchase if I make an offer. They also have a great filtering tool that allows me to only see listings that meet my specific criteria. My preference is for sites with at 30,000 monthly unique visitors that is focused in a fairly specific topic that is not trendy of fad-related.

New listings are posted every Monday morning around 7:00 am Pacific time. It’s not uncommon for a listing to sell within minutes. Once you review the new listing, you can “unlock” it to gain access to the domain name, financial documents and proof of earnings. Unlocks are limited to your price range to protect the confidential information from going to anyone who isn’t qualified to purchase.

The unlocked listing will provide you with everything you need to make a purchase decision. In addition to the domain name and financials, you automatically gain access to the Google Analytics data. This is extremely valuable in evaluating the website traffic, most popular pages and other metrics.

For example, you might find a website centered around cat travel carriers with 40,000 monthly unique visitors, but the Google Analytics show that one page gets 20,000 and another gets 10,000. If most of the traffic is coming from Google searches, the site has more risk of losing traffic if they decide that another website has a better article that these. It would be much preferred to find those 40,000 visitors spread out over dozens of pages. An ideal target is around 1,000 average views per page.

MotionInvest

This is terrific place to shop for smaller websites for those who want to limit their investment or find a smaller site that will compliment one they already own. It’s common to find listings for just a few thousand dollars as well as some in the tens of thousands of dollars. MotionInvest was co-founded by Spencer Haws from NichePursuits.com. If you haven’t heard of him, you need to visit his website and check out his terrific podcast.

One unique thing about MotionInvest is that they act as a wholesaler as well as a broker. This means that they purchase some websites from people and then list them for sale as a portfolio. That process differs from the typical broker who lists websites owned by others. The advantage to the buyer is that the MotionInvest team has already been able to fully vet some of these and discover the good, bad and ugly.

However, their disclosure on regularly listed sites is quite good also. They provide a very transparent overview of the financial performance, website traffic, search engine optimization (SEO) analysis and other key metrics. Although I check this site regularly, the one downside is the limited number of offerings available. Since my search criteria is targeted towards sites that are good candidates for advertisement revenue, most of the smaller sites aren’t a good match.

WebsiteClosers.com

If you are in a higher price range, WebsiteClosers is a great place to shop. With my current focus in the sub-$100,000 range, there isn’t much for me here, but it does give me an idea of how big some sites can grow when managed properly. I have a website focused on raising backyard chickens that has not yet reached 10,000 monthly visitors. Finding a listing on WebsiteClosers.com for a multi-million dollar listing in the same topic area, helped me realize how much potential is there.

WebsiteClosers also works with business loan brokers to help secure financing for these deals. This is important since purchasing in the $350,000+ range does require professionals who know how to handle a large deal and navigate the complexities that come with them.

Their website provides a lot of good information, but not to the level that MotionInvest or EmpireFlippers does. WebsiteClosers seems to operate more like a traditional business broker with more focus on the deal management with the sales executive playing the key role in the flow of information instead of leveraging automation.

This is neither good, nor bad, just differences to consider.

Investors.club

Based in Australia, Investors.club uses a membership model that gives paying subscribers access to new listings before non-paying members. I have mixed feelings about this since I know that the best listings on EmpireFlippers sell very quickly, so I figure every listing I see at Investors.club was rejected by other buyers already since I’m not a paying member.

I’m not convinced that $59 per month (November 2020 rate) is worth it just to see listings before others. Maybe I’m wrong about this and maybe I’m missing out on some great deals over a relatively small amount of money. If I had to pay a monthly fee for every brokerage, this would really add up and I’m just not convinced that this is the best model for me. Yet, I still browse their listings on a regular basis.

They do charge a lower sales commission to the seller, 5% compared to 15% for most others. As a non-paying member, once listing are made available to me, they come with a pretty good amount of information. If you want a more detailed analysis of the listing, non-paying members can access a full report for $27 per listing.

Investors.club offers a unique business model that is designed to discourage casual browsers and tire-kickers by using a fee structure that is quite different from others. It’s actually not too different that the flat fee real estate brokerages that have gained popularity in the last 20 years or so. Maybe I’ll sign up for paid access in the near future and see what I’m missing out on.

I first learned about Investors.club from the podcast called “Buying Online Businesses” hosted by Jared Krause in Australia. He offers a lot of great information and interviews people who have purchased websites. You can find him over at BuyingOnlineBusinessses.com.

How the website buying process works

Much like buying real estate, there is a formal process involved when purchasing through a broker. Typically, it involves clicking on a “make offer” or “buy now” button. From there, you will likely have to agree to some terms and prepare to make payment.

Since this is a sizable purchase, the payment is usually made by a bank wire transfer. However, many will allow or require that you make a partial payment by credit card to commit to the deal. Wire transfers are generally not reversible or cancellable, so be very careful during this step to avoid a costly mistake.

The search for the right website to purchase

The key to success in finding the right website to purchase is having a pre-determined criteria. It’s OK to adjust and re-evaluate that criteria periodically, but don’t do that just to make it fit a listing that looks good except for this one thing. That one thing is why you made the criteria; to avoid it.

For example, you find a website that meets all of your criteria except one, the monthly visitor traffic. You set 10,000 as a minimum and this one has 6,000, but it meets all of your other requirements. So, you decide to make an offer since you like the domain name, website design and style. By the time you take over ownership, that monthly traffic has dropped to 4,000 since one article was getting most of the traffic, but suddenly isn’t any longer.

Protect yourself by building you criteria list before you decide to buy. Here’s an example of what I use to evaluate listings:

Website Evaluation Criteria

| Criteria | Comment |

|---|---|

| Monthly earnings >$1,000? | |

| Monthly unique visitors >30,000? | |

| Valuation multiple >30? | |

| Monthly traffic is trending slightly upward, downward or flat? | |

| Site traffic coming from the U.S. is >75%? | |

| The site does not use Private Blog Networks (PBN)? | |

| What can I do to increase the traffic or revenue? |

I must be able to answer YES to the first 6 items and have a clear answer for the 7th. Sticking to this criteria helps me avoid making a decision swayed by emotion or shiny objects.

Performing due diligence

The due diligence process is the most important part of the whole process. In a typical business purchase, due diligence is done after the offer is made and accepted. It’s a period of time that allows the buyer to see all of the evidence that proves the sellers statements around finances, traffic and operations.

If you were buying a plumbing company, you would use the due diligence period to have an accountant review all of the recent bank statements, tax returns, account payable and receivable. You would also review the inventory of parts, vehicles and tools. A review of all employees may be included to make sure they have no outstanding back pay, legal claims or other issues. Your attorney would look over other aspects of the business to make sure everything is inline.

After all that is done, due diligence is complete and the rest of the deal can proceed to closing.

With a website business in the sub $100,000 range, it’s a much simpler procedure. You review the earnings statements, website traffic analytics, the profit and loss statements and any other documents related to affiliates or advertisement services. This is usually provided in the full brokerage listing, so your due diligence is done before the offer is made.

Making the offer

Each brokerage is different, but the overall process usually involves making a partial or full payment to the broker, if they are also acting as an escrow agent, or to a third party escrow service. Having your money held in escrow if very important. You don’t want the seller to touch one dollar of your money until you have full ownership of the website, domain name and all related assets. Likewise, the seller doesn’t want you to own those things unless it’s certain that the full amount due to safely secured in escrow.

Expect to make a bank wire transfer and follow the instructions very carefully. Your bank will most likely call you to verify the details, even if you complete their online forms correctly. They know that wire transfers contain higher risks compared to credit card transactions. Some brokerages, like EmpireFlippers, allow you to wire money in advance of a purchase. The reason for this is that the first money received wins the deal.

They may post a new listing for a $50,000 website. It’s a great deal and three people click on the “buy now” button. They are instructed to wire the full amount quickly since the first one who’s money arrives in their escrow account wins the deal. Two of the people go to their bank’s website and initiate the wire transfer. An hour or two later, they may get a call from the bank to verify the details and schedule the transfer for that afternoon.

However, the third buyer wired money to EmpireFlippers several weeks ago, so his money is already there and arrives first. He wins the deal. Now, the deal is accepted and moves to the migration phase.

The Migration process

During the migration process, the seller will be asked to set up web hosting, domain name registration and other accounts to allow these things to be moved into their name. You should expect to grant the person handling the migration full access to these accounts since they will need it to perform these tasks. Once they complete the work, you can change passwords as needed.

There is some due diligence that happens after the offer is accepted which includes greater validation of the stated income by viewing the income reports in a scree-sharing session with the seller. It may also include having all revenue transferred to your affiliate or ad services accounts for a period of time to verify the earnings. This is especially helpful if something unexpected changes during the migration process.

At some point in the migration, the affiliate accounts and/or advertisement accounts will switch over to you so you can truly validate the income for the first time. This is also the time to speak up if the numbers don’t match up to what you expected.

Some brokers, like EmpireFlippers, offer a two week period to inspect the website and earning for any material defects or deficiencies. I’m not sure about how this works with others, but EmpireFlippers terms state that if the actual earnings during the inspection period are less than 50% of the pro-rate advertised amount, the buyer may cancel the purchase. This is a big deal.

If you don’t have an escape clause like that, you could end up owning a website that earns a small fraction of what you expected with no recourse. Now, 50% of expected earnings may seem really low, but daily revenue varies from day-to-day it’s not unrealistic for a website to have a short term income reduction that quickly bounces back. If it fails to meet that 50% threshold, the buyer has the option of renegotiating the purchase price or walking away, which you should be fully prepared to do.

Final closing and financial settlement

Once all of the migration work is complete and you’ve inspected the website and earnings, it’s time to move on to final closing. This will usually involve you acknowledging that everything is in order and verifying that it’s OK to proceed with any final documentation transfers like standard operating procedures, article templates, outsourcing resources used, etc. It also authorizes the broker or escrow agent (if different) to disperse the funds to the seller. This normally concludes the deal unless there are additional terms that require withholding funds for a period of time to assure earnings stay consistent.

As the buyer, you’ve already transferred the money, so there isn’t much for you to do during this phase beyond the final approval that all is in order.

What to do after the purchase

Now that you are the proud owner of a new website, what do you next? First of all, avoid making any substantial changes for a while. The site just moved to a new hosting account, a new domain name owner and was all transferred by someone who may have inadvertently altered something. It’s best to give it a few weeks, at least, to make sure you don’t find any broken links, missing pages or other problems that need attention from the person who did the migration or possibly even assistance from the seller.

After this cooling period, it’s time to start making improvements where it makes sense. You most likely identified some things to change before the purchase, so now you can put your plan into action.

Add content

For most content-based websites, adding new content is the lifeblood of attracting new visitors and keeping people on your site to read more interesting and helpful information. If the seller didn’t provide a list of article topics that was in their to-do list, you will want to get one built so you can plan your writing priorities.

If you follow the solid advice from IncomeSchool.com, you will focus on three types of articles; response posts, staple posts and pillar posts. Response posts are shorter and designed to answer a specific question that someone would ask Google. Staple posts are longer and address a topic in more detail than just an answer to a single question. Pillar posts are your long form articles that go deep, share your experience and provide expertise. This article you’re reading is an example of a pillar post.

Building a list of targeted keyword articles that address questions and topics that people are already searching on Google is your content’s foundation. If you’re not sure how to do this or don’t want to spend the time, you can hire the folks at TextGoods.com to help. They offer a Search Analysis service that is reasonably priced and well worth the money. I’ve used them for search analysis and for writing pillar, staple and response posts. They delivered quality work without the need to rewrite or correct grammar. Many writing services are outsourced to non-native English speakers, so the articles typically require quite a bit of correction before publication.

Take the time to provide great articles with really useful information. You’re not just writing for the Google search algorithm, you’re writing for the real people who will read and use your content.

Change or implement advertisements

The main reason I use monthly unique visitors as a search criteria is to make sure there is enough traffic to qualify for premium ad services like Ezoic and Adthrive. It’s common to find websites that started running ads through Google Adsense when their traffic was small and never bothered to change to a better service once their traffic volume qualified.

You can get approved to run Adsense on very small websites, but you get lower revenue from them. While Adsense may pay out $1-3 per 1,000 impressions on most websites, it’s not unusual to earn $10 or more per 1,000 impressions from the premium ad services.

So, finding a website with 30,000 unique visitors with Adsense as their revenue source usually means that by just changing the ad service, I can double the income, or more.

In other cases, a website is getting a lot of traffic and earning its income from affiliates like Amazon Affiliates. If the website isn’t already overloaded with Amazon product links, banners and native shopping ads, I’ll consider the benefit of placing ads to increase revenue.

This is a judgment call since too many ads and links diminish the value of the content on the page. Another cost is the time it takes for ads to load onto the page. As a web page gets slower, it can lose value in the eyes of the Google search engine. If your page is competing with three others for certain keywords, the slowest loading page may lose out to the one that loads faster.

Change or add affiliate offers

The most popular affiliate program in the world is Amazon Affiliates. It’s no wonder since it’s a trusted site with the largest product catalog know to man and incredibly large customer base. Clicking on a product link means a very easy purchase process since most people already have their credit card info, shipping address and other preferences save on the Amazon site. This is also known as low friction to purchase.

The downside of this for the affiliate is that the commissions are quite low and they keep going lower. If you buy a website that makes all of its income from Amazon Affiliates in a product category that earns a 4% commission, imagine your disappointment when Amazon suddenly announces that the rate will drop to 2% or lower in 30 days. It happens.

Over the last ten years, Amazon commissions have steadily dropped. GeniusLink wrote a great article showing the historical trends. While Amazon can almost guarantee you the best conversion rate of your visitors into buyers, there is a heavy cost. It might be worth looking at alternatives.

Hubspot published a list of 44 affiliate programs that pay the highest commissions. It’s definitely worth reviewing this list to see if there’s a better option. The best part is that you don’t have to give up your Amazon commissions to try a new affiliate, just start adding new links and monitor your results.

Do nothing

If you are happy with the website’s performance, maybe you should just do nothing. Seriously. There are many websites that haven’t seen a new article in years that continue to draw traffic and earn good money. This isn’t typical, but it happens.

Sometimes the niche is so small or obscure that no one has bothered to compete with your content. Or maybe you rank number one for most of your keywords and adding new content may only end up competing with your existing content. While I wouldn’t recommend this for most people who want to take a website and build it’s traffic and income, it’s an option.

Monitor your performance metrics

If you’ve ever been in business or managed part of a business, you probably know about measuring your metrics. These are they key indicators that tell you about the health of your operations. The same thing applies to your home or your car. If your gas mileage starts getting worse or your monthly heating/cooling bill starts to climb, these are metrics that are trying to tell you something.

For a website business, this is usually site visitors and earnings. The most popular tool for measuring and monitoring traffic is Google Analytics. You always want this tool running on your site since it’s a trusted tool to prove historical trends that is needed when you sell your site, plus it allows you to see deep into the performance of individual web pages, the countries where your visitors are from as well as dozens of other valuable data points.

Earnings measurement tools will vary based on the income source. If you’re relying on ad revenue, the service provider will give you access to see earnings on a daily basis, typically. For affiliate programs, there is usually a similar platform available. I try not to worry about day-to-day fluctuations, but I do focus on weekly and monthly trends.

Some sites have seasonal changes that are expected. As spring time get close, my backyard chickens website sees an increase in traffic and revenue, but I know that it will drop off when summer ends. The important thing to determine which metric you will measure and then establish a baseline so you can identify changes as they occur.

Rinse and repeat

Ideally, you buy one website, make the appropriate changes to increase traffic and revenue, then let it earn money for you month after month. Then buy another one and repeat the process. By being selective in your acquisition targets and buying only websites that meet your strict criteria, you have a great chance of success and a rapid return of your investment.

All indications are that this type of website business will continue to grow as more people turn to the Internet to answer their questions and solve problems. You can help people by providing great content and earn a nice income at the same time.